401k Limit 2025 Employer Contribution

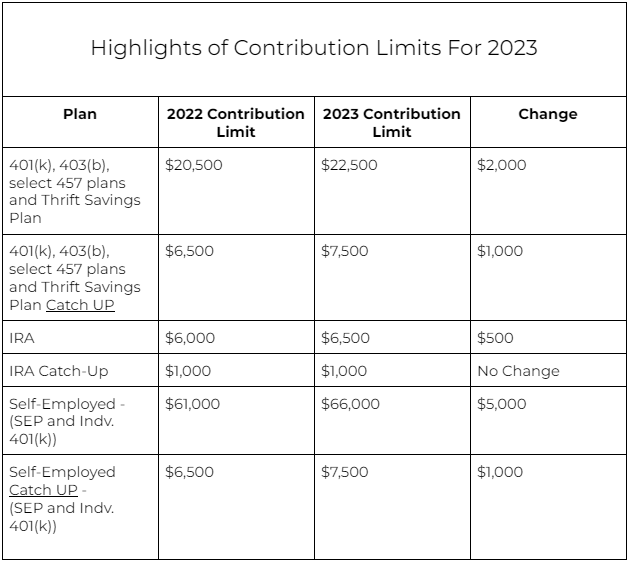

401k Limit 2025 Employer Contribution. For those 50 or older, the limit is $30,500. For 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

The most you can contribute to a 401 (k) in 2025 is. Find out the irs limit on how much you and your employer can contribute to your 401(k) retirement savings account in 2025 and 2025.

Irs.Gov 401k Contribution Limits 2025 Anthe Bridget, The limit for employee contributions to a 401 (k) in 2025 is $23,000 for those under 50.

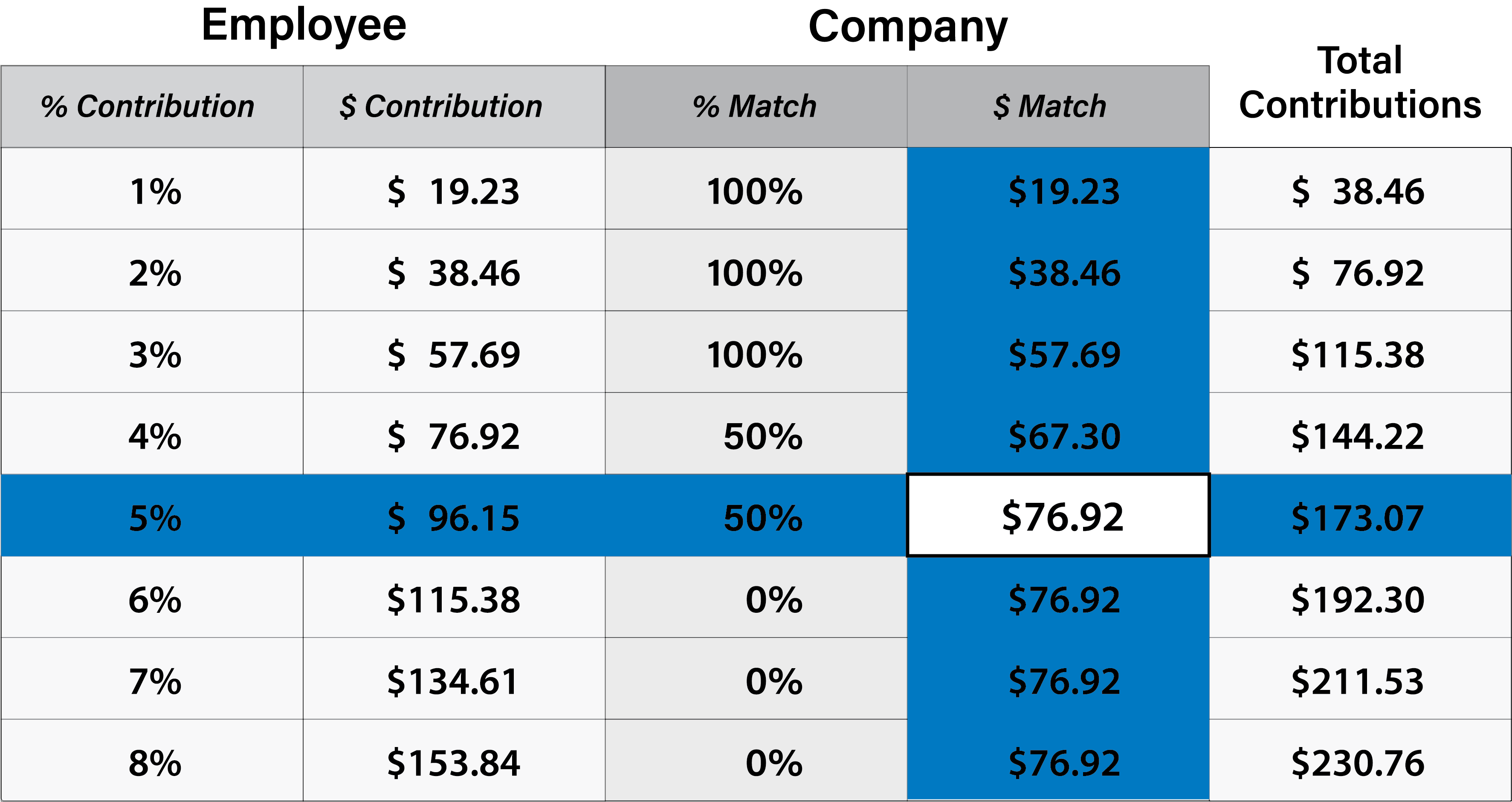

401k Limits 2025 Include Employer Match Contribution Nita Margalo, More people will be able to make contributions to.

401k Limit 2025 Employer Contribution In India Rae Leigha, 401 (k) contribution limits for 2025.

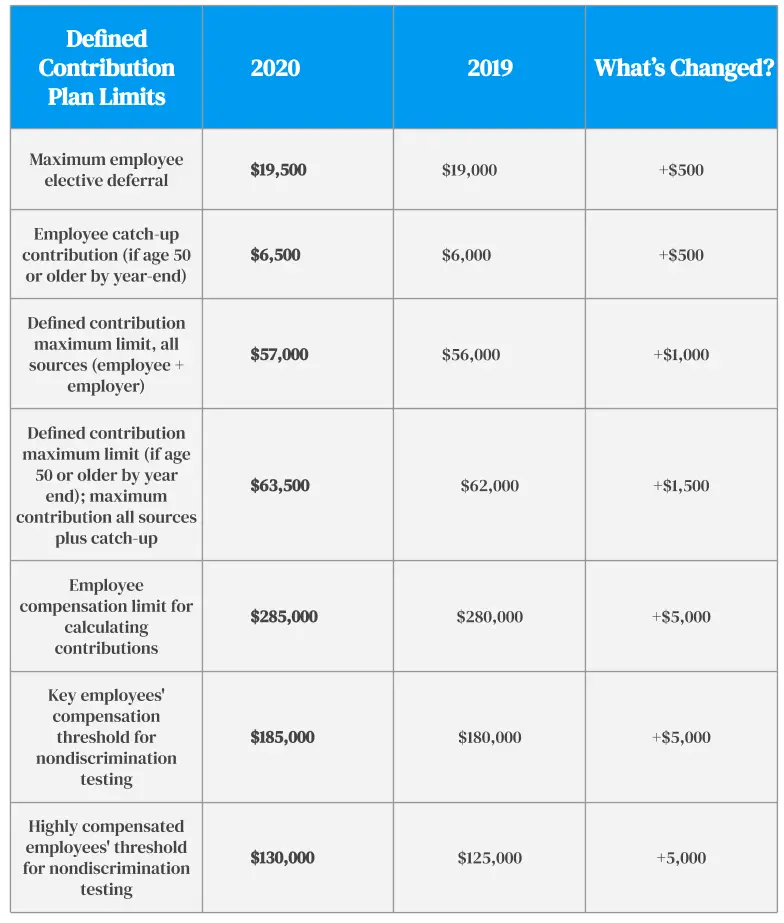

Irs 401k Employer Contribution Limits 2025 Dawna Erminia, For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500.

401k Contribution Limits 2025 With Employer Match Kaile Marilee, The 401(k) contribution limit for 2025 is $23,000.

401k Limit 2025 Employer Contribution Calculator Jami Merissa, If you're 50 or older, the limit is $8,000.

401k 2025 Contribution Limit Catch Up Rene Kristel, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up.

401(k) Contribution Limits in 2025 Meld Financial, Deferred compensation limits for workers ages 50 and older.