2025 Tax Withholding

2025 Tax Withholding. Withholding tax is tax your employer withholds from your paycheck and sends to the irs on your behalf. Updated on june 30, 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, This button is located on the top of right corner of the form. The tax slabs will be as follows:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. A simplified guide for 2025.

W4 20232024 Form Fill Out and Sign Printable PDF Template airSlate, The tax slabs will be as follows: If too much money is withheld throughout the year, you’ll receive a tax refund.

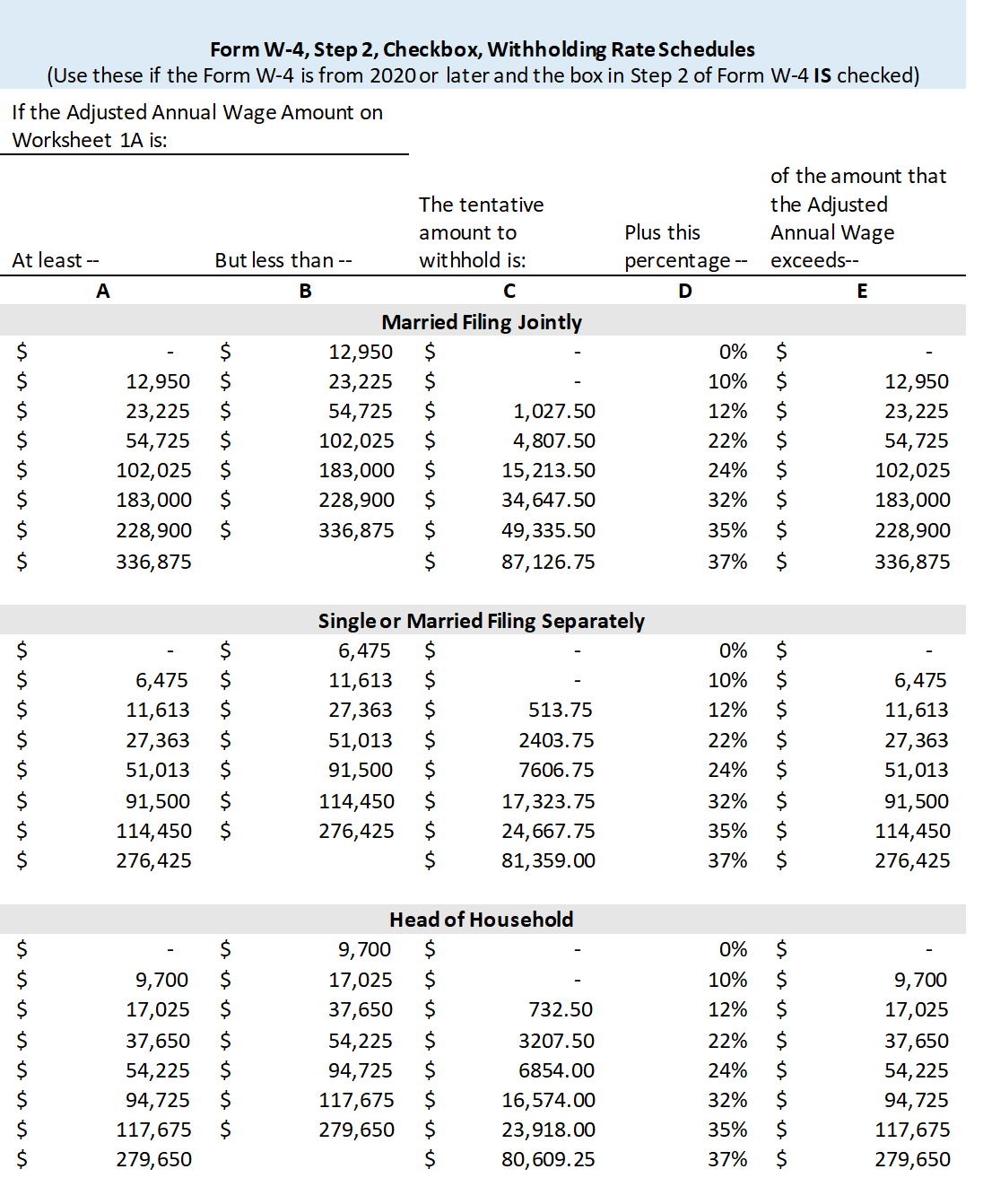

Tax rates for the 2025 year of assessment Just One Lap, The amount withheld is paid to the irs. The federal income tax has seven tax rates in 2025:

20242024 Tax Calculator Teena Genvieve, Credits, deductions and income reported on other forms or schedules. Stacks of cash getty/pm images.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, 2025 michigan income tax withholding tables. Americans are getting an average tax refund of $3,109.

Tax Withholding Tables For Employers Elcho Table, Credits, deductions and income reported on other forms or schedules. A tax refund in the spring sounds nice, until you realize the irs has.

Federal Withholding Tax Table Matttroy, For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be about. Credits, deductions and income reported on other forms or schedules.

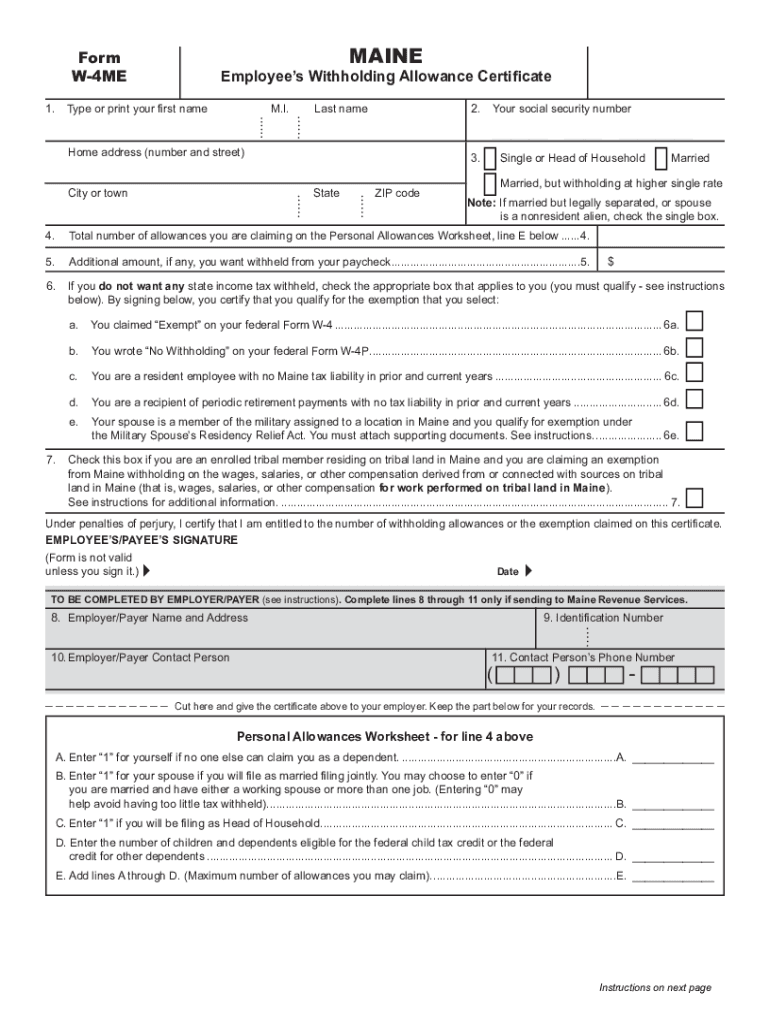

IRS Form W4 Download Fillable PDF or Fill Online Employee's, The amount withheld is paid to the irs. W4 tax withholding steps 2 to 4 explained | 2025 | money instructor.

Publication 15 Federal Tax Withholding Tables Federal Withholding, What are income tax withholding tables? Pakistan introduces rules for online integration of businesses to process payment of digital invoices and income tax withholding.

For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be about.